Despite Troubles, Tesla's Valuation Remains Sky-High

- raquelgoulartra

- Jan 14

- 2 min read

This article is published in collaboration with Statista

by Felix Richter With global sales declining for a second consecutive year, things looking increasingly bleak in Europe and CEO Elon Musk dominating the headlines with his political activities, it's hard to look back at 2025 as a good year for Tesla. The company may still be the second largest electric car maker in the world with some exciting initiatives in the pipeline for the future, but in the present, it is facing ever more intense competition in the EV market with an ageing model line-up and a brand image that has been tarnished by Musk's association with the Trump administration and his endorsement of the far right in countries like Germany and the UK. And yet, Tesla's share price increased 11 percent in 2025.

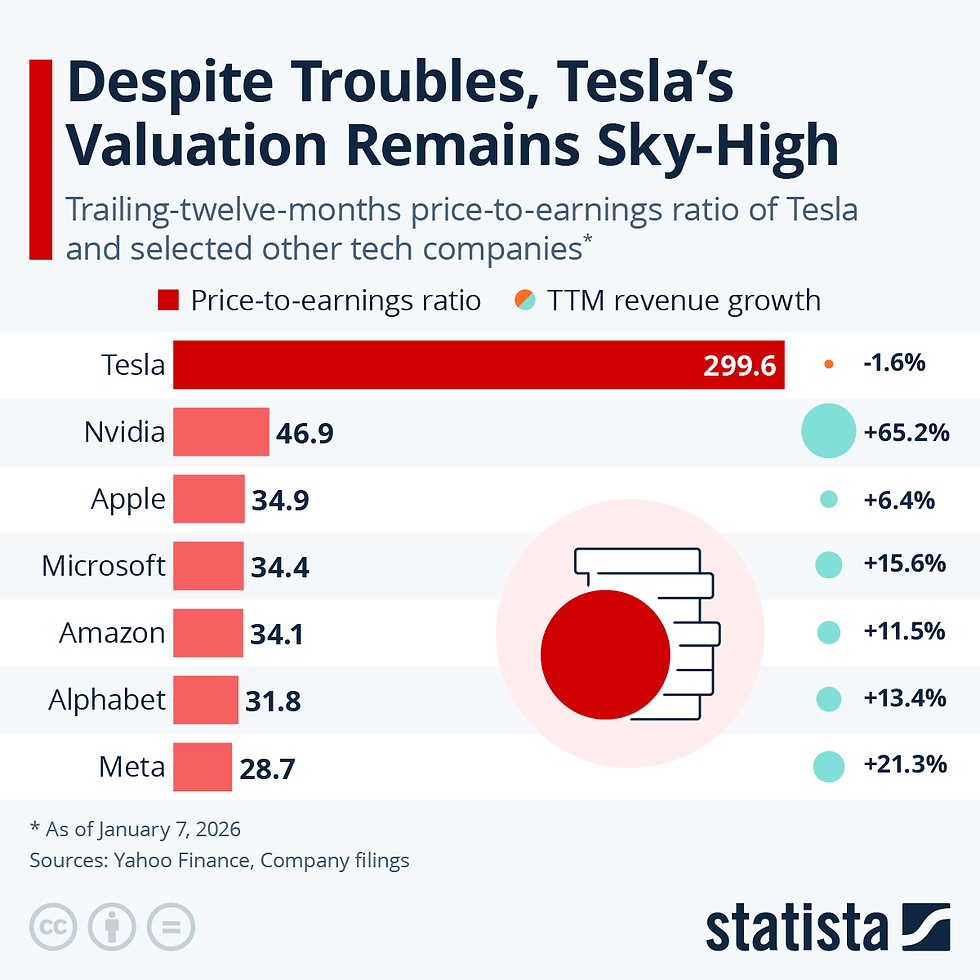

With a market capitalization of $1.4 trillion, Tesla is not only the world's most valuable car maker, but it's valued higher than the next 20 car companies combined. That includes pretty much the entire legacy car industry as well as relative newcomers such as BYD and Xiaomi. At it's current price, Tesla is valued at almost 300 times its trailing-twelve-months earnings. To put that in perspective, even AI juggernaut Nvidia, a company that many consider overvalued, has a TTM price-to-earnings ratio of "just" 47. Nvidia is already at the very heart of the industry that will supposedly re-shape our lives for years to come, however, while Tesla's valuation is largely based on the vague promise of self-driving cars and humanoid robots. In the past four completed quarters, Nvidia’s revenue grew 65 percent – Tesla’s declined 2 percent.

Tesla’s current valuation is almost entirely rooted in Musk's reputation as a visionary and the belief that he can turn Tesla into a future leader in robotics and autonomous driving - a belief that is reflected in the ambitious goals laid out in the controversial $1-trillion CEO pay package that shareholders approved in November 2025. Start leaning Data Science and Business Intelligence tools:

createandlearn#analytics#dashboard#finance#accounting#tableau#powerbi#excel#sales#datascience#businessintelligence

Comments